Flow of Funds

Bakkt categorizes fund flows into three distinct models to meet the varied needs and services of our clients. This guide is designed to help clients identify and understand which fund flow framework best aligns with their platform. These three fund flows are segmented into: Bakkt Marketplace, Net Settlement, and Apex Clearing.

Core Concepts and Functionality

Bakkt Funding Models

- Bakkt Marketplace: For clients that utilize Bakkt's fiat onramps to fund customer trades, this entity handles all fiat movement.

- Net Settlement : For clients that manage their own fiat onramps to fund customer trades via a private Banking as a Service (BaaS) provider, the daily settlement process happens on a net basis at 9AM Central Time.

- Apex Clearing: For clients with brokerage accounts, their fiat funding goes through their brokerage account at Apex Clearing.

Key Components

- Bakkt Best-Bid-Offer (BBO): A system that aggregates and refreshes pricing with our various liquidity providers to identify the best current bid and offer.

- Bakkt Order Management System (OMS): Processes order execution and requests for fund movement, applying risk controls to verify orders are at least 1$, do not exceed the customers holdings, and if they are marketable by constantly communicating with Bakkt BBO.

- Bakkt Trade System (BTS): Within BTS is an omnibus bank account/system that ledgers funds accordingly, distinguishing individual customer funds within the system.

- Bakkt Crypto Solutions (BCS): Entity handing Crypto trading.

- FBO (or "For Benefit Of"): A special financial account where funds are received and held on behalf of a third party. Customer fiat funds are consolidated into a single FBO account with individual ledger entries for each customer.

- Commission Models: Markup (commission included in price) and Trade Fee (transparent commission itemized separately).

- Reconciliation: Clients utilizing Bakkt's Fiat Funding Onramp will have full visibility into their cash transactions through the cash activity and cash balance reports we send.

- Immediate Trade Execution: Trades are executed immediately with cash calls for executed trades processed asynchronously and retried twice daily for collection, if they fail and continue to fail, these trades will fall into the Aged TPJ File.

- Buying Power: It is the client's responsibility to manage customer buying power by utilizing the Aged TPJ File provided by Bakkt in their S3 buckets. This file, containing all unsuccessful TPJ transactions, is essential for adjusting buying power accurately.

Flow of Funds Diagrams

Each funding model contains multiple internal flows. The "Internal Flow Key" section gives a high level breakdown of what each flow does, preparing you to understand the diagram comprehensively and appreciate the synergy of all components.

| Internal Flow Key | Definition |

|---|---|

| Trade Flow | Shows the process from customers receiving live market data to order placement and final execution. |

| Settlement Flow | Details the money movement between the customer FBO account and the Bakkt Business account to settle trades. |

| Customer Funding Flow | Covers the process of customer moving funds from their Plaid linked bank account to their crypto trading account. |

| Net Settlement Flow | A daily reconciliation process where all parties review trade reports, confirm transactions, and settle all individual balances in a singular net money movement. |

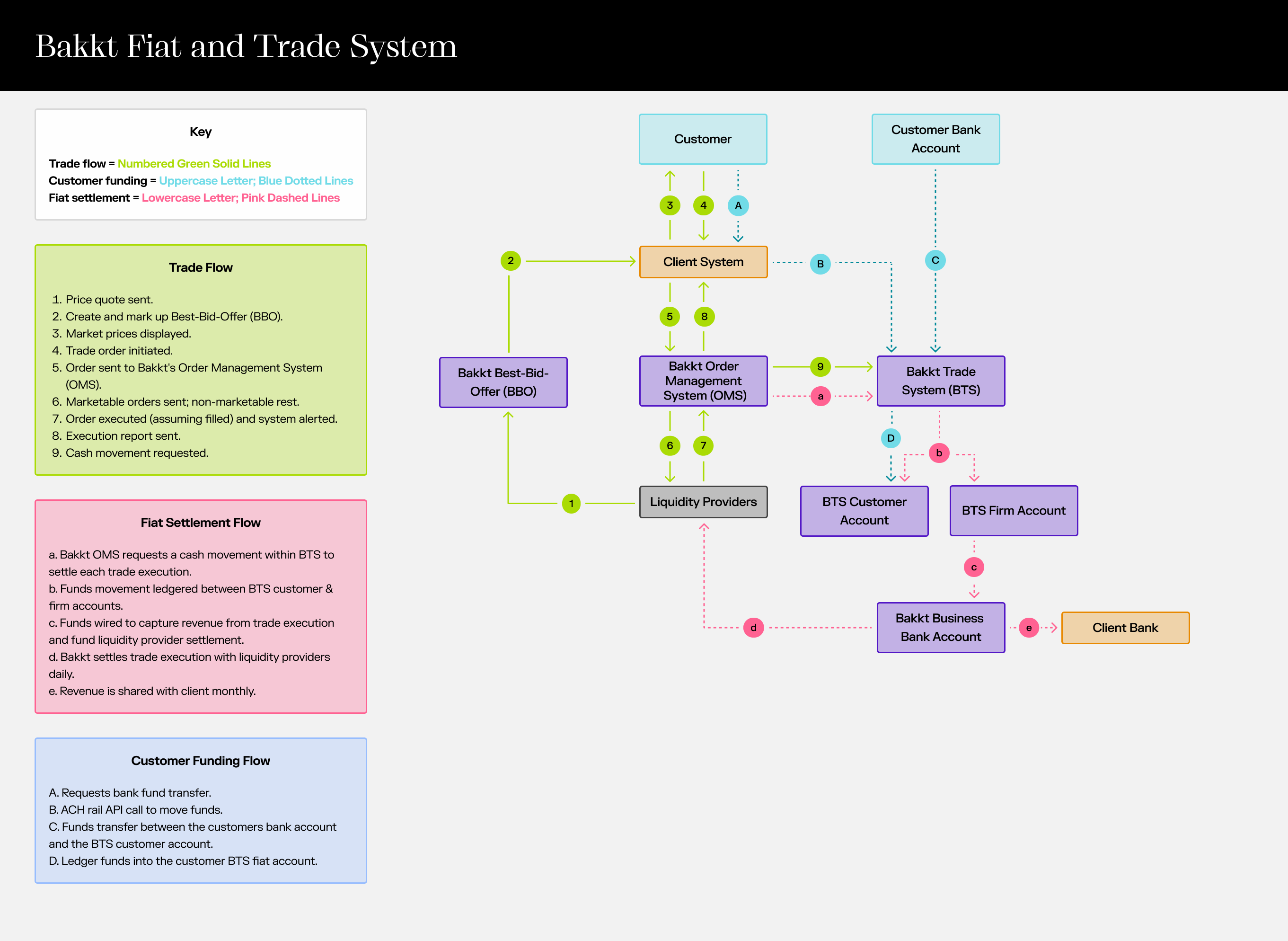

Bakkt Fiat and Trade System

Clients that utilize Bakkt for their fiat onramp to fund customer trades will find this diagram useful to explain how trades are executed from market data to order completion, funds move between accounts to settle trades, and customers fund their trading accounts from linked bank accounts.

This flow assumes customers have linked their bank accounts for ACH fiat transfers via Plaid's embedded API integration and that clients have integrated with Bakkt's ACH API.

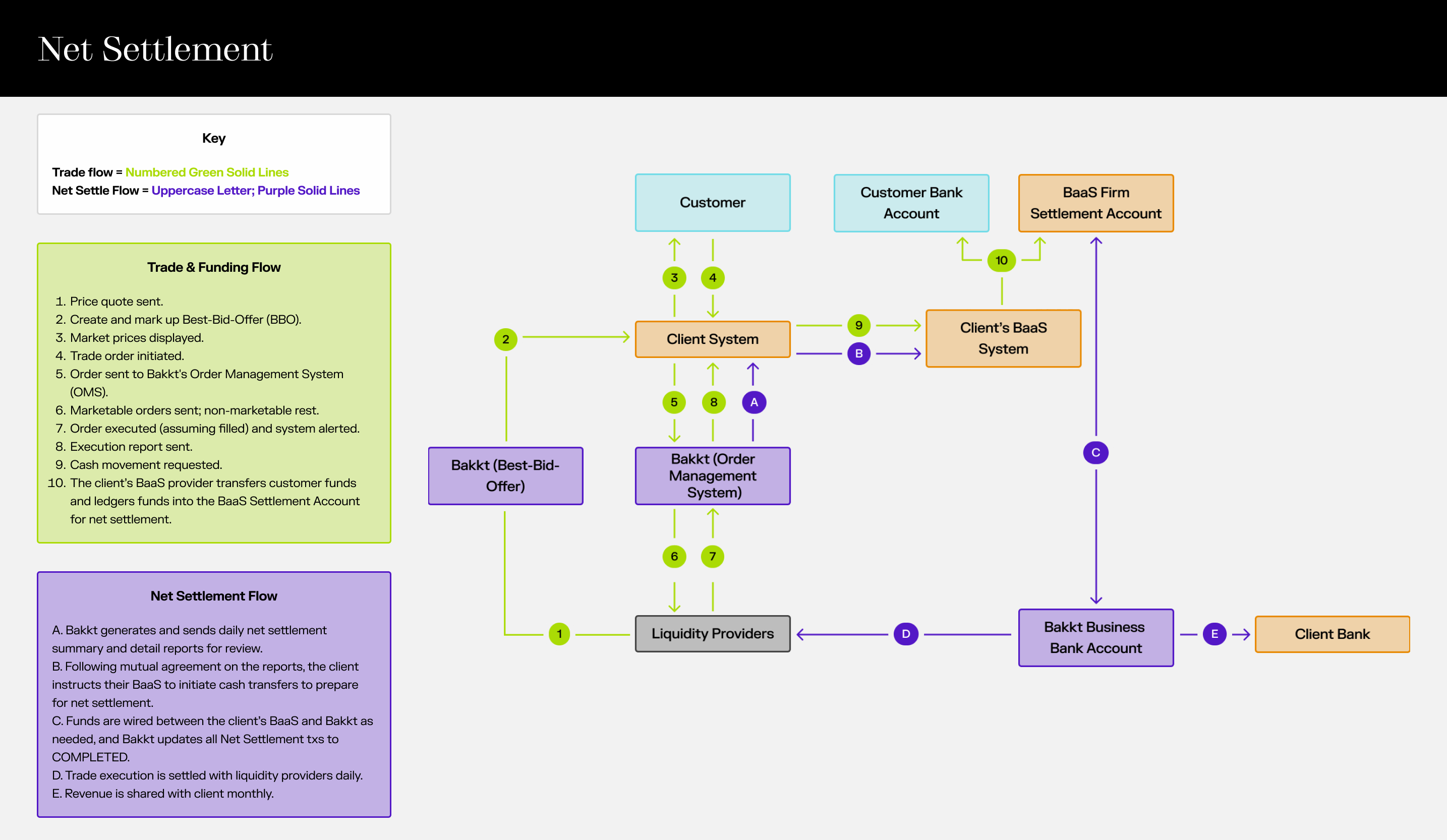

Net Settlement

Clients with their own BaaS and fiat funding rails to facilitate customer's fiat onto the platform will utilize a Net Settlement approach and find this diagram useful to explain how trades are executed from market data to order completion and works with the clients system.

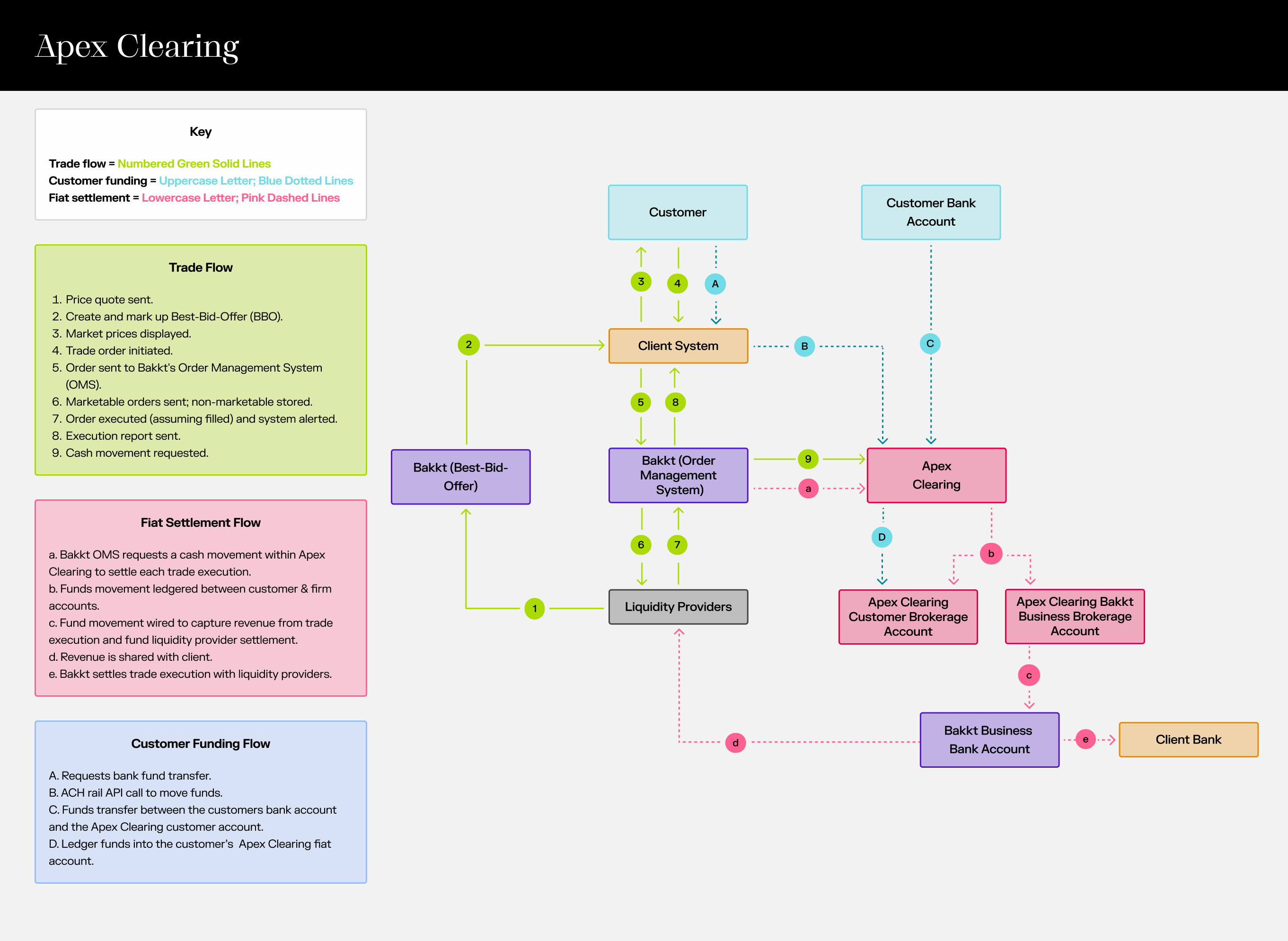

Apex Clearing

Clients with brokerage accounts can have their fiat funding go through Apex Clearing. Clients will find this diagram useful to explain how trades are executed from market data to order completion, funds move between accounts to settle trades, and customers fund their trading accounts from linked bank accounts.

Updated 6 months ago